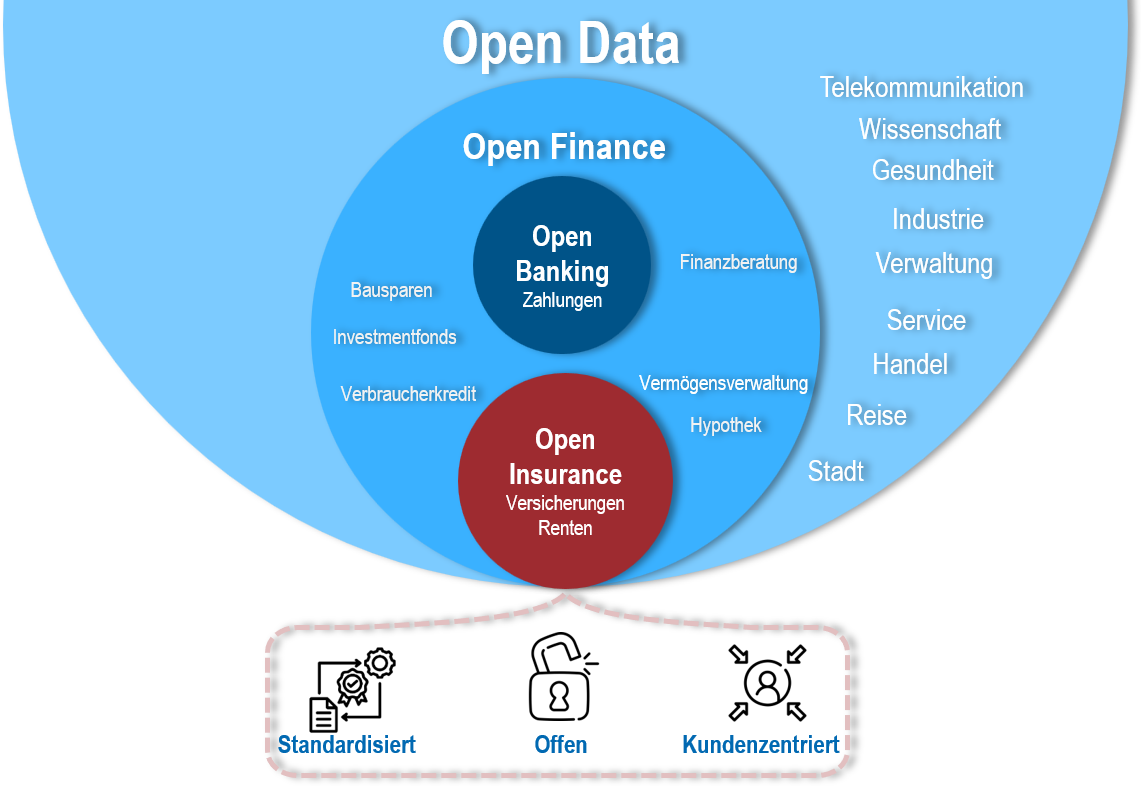

Open data

The concept in general and the EU strategy “Open Data” is based on the fact that data sets from a wide range of industries are made available to authorized third parties for use and further use in a machine-readable, standardized form.

Open Finance

Open Finance is an emerging concept in the financial sector that is based on similar principles to Open Banking but goes beyond traditional banking services. It aims to open access to financial services and data to promote innovation, competition and transparency.

At its core, Open Finance is about giving consumers control over their own financial data and being able to share it securely and easily with other financial service providers. This allows consumers to benefit from a wider choice of financial products and services that are better tailored to their individual needs.

A central concept of Open Finance is the use of APIs (Application Programming Interfaces) to enable the secure exchange of financial data between different providers. By using APIs, third parties can develop innovative financial services that build on existing data, such as personalized savings and investment platforms or financial planning tools.

Open Finance offers a variety of benefits for consumers, including:

1. More choice: Consumers can choose from a variety of financial products and services that are better tailored to their individual needs.

2. Better prices and conditions: Increased competition allows consumers to benefit from cheaper prices and better conditions.

3. Innovation: Financial disclosure promotes innovation and enables the development of new, customer-focused financial services and products.

4. Transparency and control: Consumers have control over their own financial data and can decide what information they want to share and with whom.

5. Improved financial planning: Access to comprehensive financial data enables consumers to better manage their finances and make informed decisions.

However, open finance also presents challenges, particularly in terms of data protection and security. It is important that strict privacy and security standards are maintained to maintain consumer trust and protect their sensitive financial data.

Overall, Open Finance has the potential to fundamentally transform the financial sector and provide consumers with an improved financial experience based on openness, innovation and choice.

Open Insurance

Open Insurance, which is part of Open Finance, is part of the Open Data strategy and is defined by EIOPA (European Insurance Authority) as “access to and sharing of consumer data related to insurance services between insurers, intermediaries or third parties to create applications and services”. The focus is on customer centricity, where services are viewed from the customer’s perspective, and customers (consumers and companies) decide whether and to what extent they make their data available to third parties (data users).