Blog

BiPRO is FiDA-Ready!

Categories

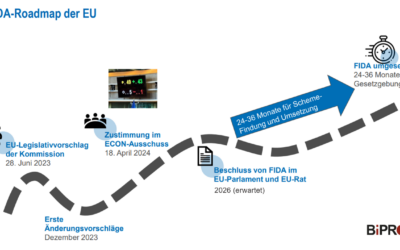

When does FiDA come into force?

Roadmap of FiDAThe ECON Committee of the EU Parliament approved the FIDA draft on 18 April. The press release of the ECON Committee announces that the decision in the plenary session of the EU Parliament will only be decided by the new Parliament after the election....

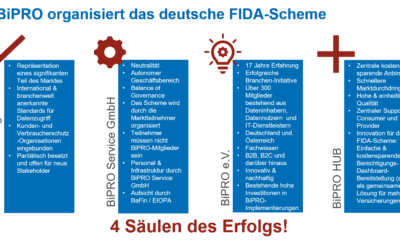

BiPRO-FiDA-Scheme – 4 pillars of success!

BiPRO organizes the German FiDA-SchemeDecision of the BiPRO Presidium The BiPRO FiDA-Scheme is organized within BiPRO Service GmbH and uses the BiPRO standards as a common standard. The management of BiPRO Service GmbH is instructed to further prepare the BiPRO...

BiPRO standards in open insurance: 5 important points to take away

Why is the BiPRO standard important? The importance of the BiPRO standard in Open Insurance lies in its ability to promote interoperability, efficiency and innovation in the industry. Here are some reasons why the BiPRO standard is crucial: 1. Interoperability: BiPRO...

BiPRO is FIDA-Ready!

At BiPRO the focus is on process optimization, standardization and community. The BiPRO-Standards are industry-wide recognized market standandards that enables sustainable digitalization of the insurance industry.

Thanks to the large BiPRO community, Germany is becoming a pioneer of digital insurance communication in the EU, while other countries and initiatives essentially have to start from scratch when it comes to establishing standards.

The BiPRO data model and the specifications of the interfaces already largely cover requirements of FIDA with regard to end customer processes and customer data. The industry-wide implementation of data transfer is well advanced for most members.

Member companies

K. Interfaces

m. Transactions p. a.

years of work

The BiPRO community consists of more than 300 member companies.

The key processes in the insurance industry were standardized together.

BiPRO community drives the digitalization of the industry.

The association has been supporting its community with know-how for almost 20 years.

Shape the future now

Free registration

Open Insurance Working Group

Personal Information:

Please provide information about yourself here.

*Data protection

By registering, you expressly consent to the data collected being stored and processed by us. The data storage/processing takes place exclusively for the purpose of conducting the above-mentioned event. The storage and processing of any previous data collected in another context is not affected by this. The legal basis for the storage and processing of the data collected with the registration is Art. 6 Paragraph 1 Clause 1 Letters a), b), f) GDPR. Please also note the additional information on data protection.

*Legal notice

I agree that the name of my company may be mentioned as a permanent participant in the Open Insurance working group of BiPRO e.V. If you do not agree to this, please send a short message to fida@bipro.net.