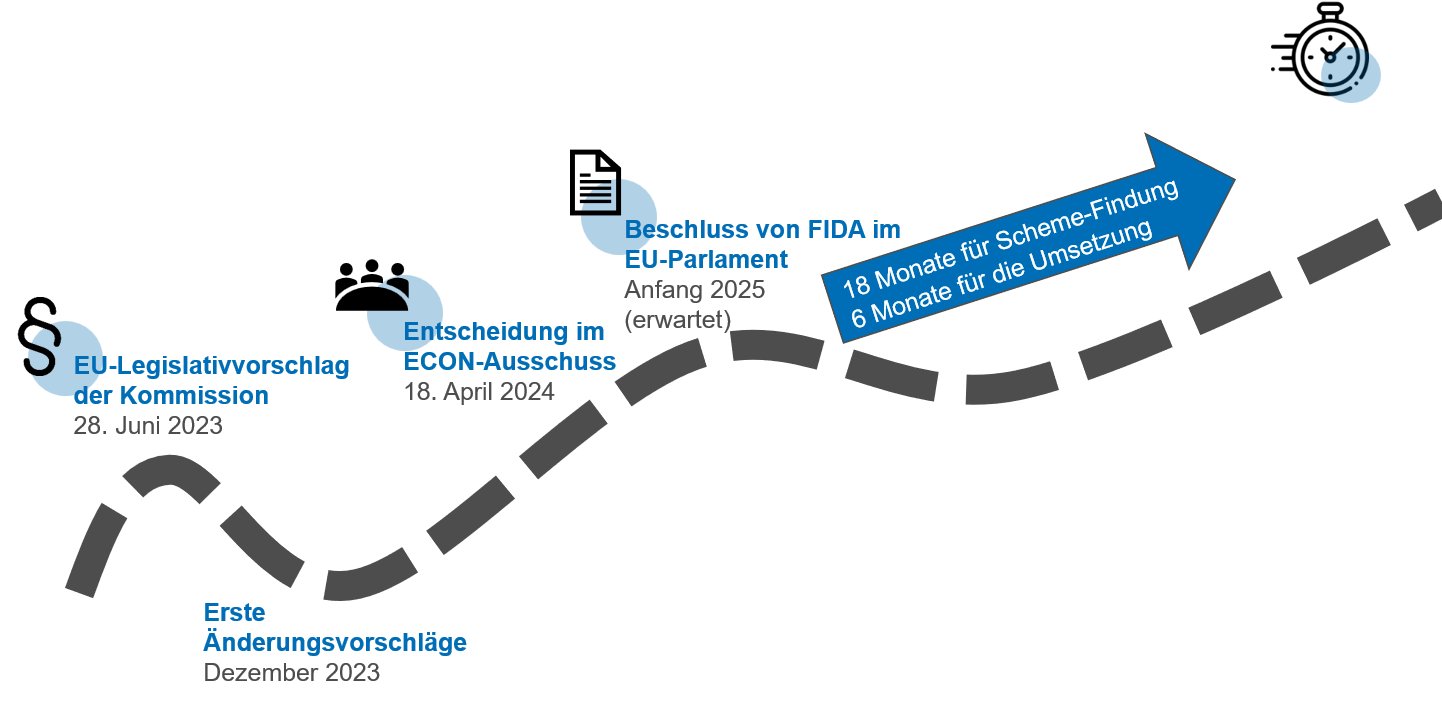

Roadmap of FiDA

The ECON Committee of the EU Parliament approved the FIDA draft on 18 April. The press release of the ECON Committee announces that the decision in the plenary session of the EU Parliament will only be decided by the new Parliament after the election.

Link to Press Release

At the same time, discussions are taking place in the bodies of the European Council. As soon as Parliament and Council have drawn up their opinions, the trialogue process between the EU Commission, Parliament and Council will start in order to arrive at a final draft law, which must then be finally approved by Parliament and Council.

A final adoption of FIDA will most likely not occur until 2025. The implementation period of 24 months (according to the current draft) then begins. In this respect, online, real-time and continuous data access for customers and data users must be implemented by 2027.