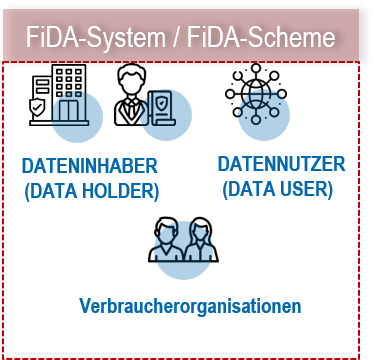

FiDA-System / FiDA-Scheme

Within 18 months of the entry into force of the Regulation, data holders and data users must become members of one or more “Financial Data Access Schemes” that regulate access to customer data.

Any access to data must be carried out in accordance with the rules and modalities of a FIDA Scheme to which both the data user and the data holder belong.

The data holders and data users organised in a system for the access to financial data must:

- represent a significant part of the market

- Be open to new stakeholders and treat all stakeholders equally

- form joint committees to make decisions for the system

- Involve advisory customer and consumer organisations

- jointly determine the remuneration that data users must pay to data holders for data access

- sich der Aufsicht durch die nationale Aufsichtsbehörde unterwerfen sowie

- establish common standards* for data and technical interfaces

*If available, established market standards should be used