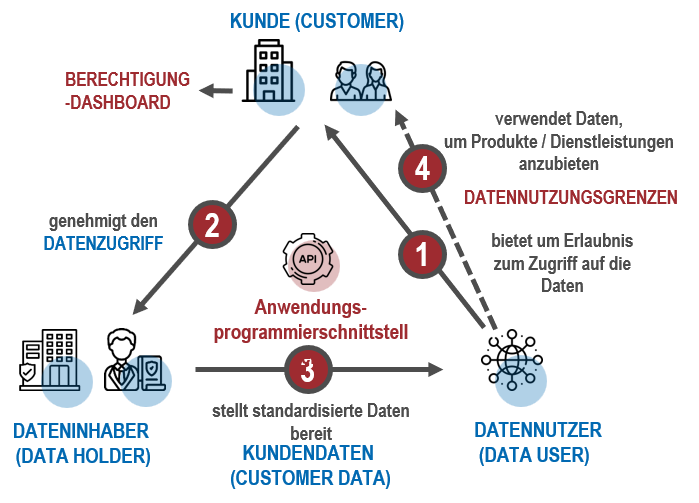

FiDA schematic diagram

CUSTOMER: Natural or legal person

DATA HOLDER: Financial institution required to grant access to customer data under this Regulation.

DATA USER is an entity (financial institution or financial information service provider (FISP)) that has lawful access to customer data with the permission of a customer.

CUSTOMER DATA: Personal and non-personal information collected, stored and otherwise processed by a financial institution in the normal course of its business with customers, including both information provided by a customer and information that arises as a result of the customer’s interaction with the financial institution.

PERMISSION DASHBOARD: allows the customer to manage and control access authorizations

DATA USE PERIMETERS: Information on data use in the provision of financial services and products (insurance, creditworthiness)

FiDA: Data access

The Data Holder shall, upon electronic request from a Customer, make the Customer Data available to a Data User for the purposes for which the Customer has given its consent to the Data Holder.

The customer data will be made available to the data user 1) based on generally accepted standards, 2) at least in the same quality as that available to the data owner, 3) promptly, 4) continuously and 5) in real time.